|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

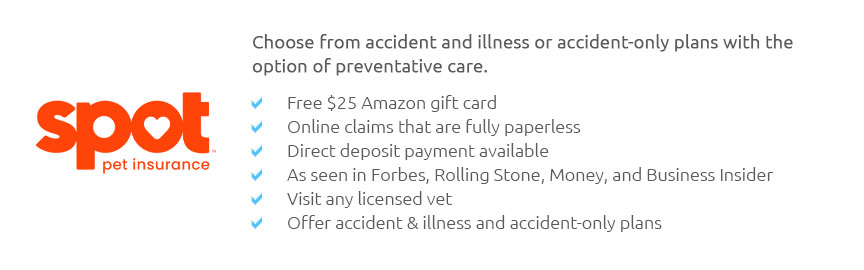

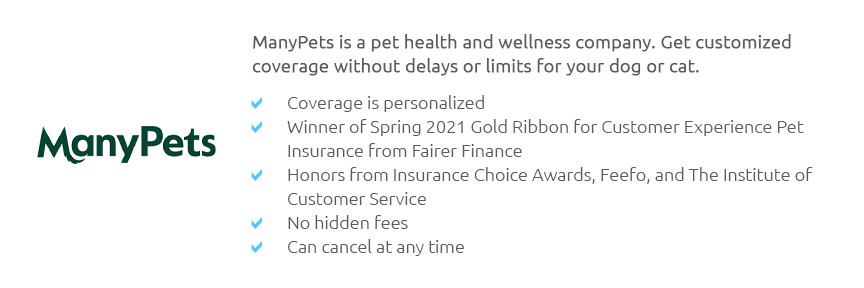

compare cat insurance plans in minutesVet bills can climb fast, and insurance helps smooth the surprises. To choose well, compare policies side by side, not just prices. The right fit balances monthly cost with meaningful protection, so your cat gets care without budget panic. Key factors to weighPolicies differ in what they cover and how they pay. Look closely at limits, waiting periods, and what counts as a pre-existing or chronic condition.

How to decide confidentlySet a realistic budget, then request quotes with the same deductible and reimbursement for each plan. Read the sample policy to spot exclusions, and check reviews for claim experiences. Compare a 12-month total cost, not just the first month, and ask how premiums may change as your cat ages. When in doubt, favor broader coverage over tiny savings. https://www.forbes.com/advisor/pet-insurance/best-pet-insurance/

While some policies include more coverage, like Pumpkin and Spot, Pets Best has the highest ratio of coverage compared to cost. In the graph below, bubbles that ... https://www.aspcapetinsurance.com/research-and-compare/pet-insurance-basics/whats-covered/

That coverage is built into our plans. Home - Research and Compare - Pet Insurance Basics - What's ... https://thepetdoctorinc.com/wp-content/uploads/2019/04/veterinary-pet-insurance-comparison-chart-printable.pdf

What makes a pet insurance plan great? We asked the companies that questionthen asked the whole field. Comparing pet insurance for you, your veterinary team or ...

|